Small-business lending corporations ordinarily demand curiosity as an yearly share amount, or APR. Some lenders, having said that, quotation fascination as an element price, which is multiplied by the level of cash you receive to find out the whole cost of your respective funding.

Microloans are available from SBA intermediaries, nonprofit companies and community lenders. These lenders have a tendency to offer business instruction, educational resources and assistance — Together with funding prospects.

Business qualifications. Associates of the business management crew need to be ready to offer a resume outlining their business and function knowledge.

In comparison with factoring, Bill financing will give you far more Management over your invoices and enables you to manage your shoppers straight.

Which loan is correct for my Nevada business? The right loan to your Nevada small business is the choice that will allow your organization to increase essentially the most though staying along with every month repayments. The good news is, you can take a look at your borrowing opportunities without spending a dime with Lendio’s online platform.

Search for a CDC by using a demonstrated track record, outstanding help services, and seasoned advisers who can assist you form your finances.

Given that we’ve reviewed that case in point plus the caveats that appear combined with the SBA 504 loan plan, let’s explore The standard functions of these loans, beginning with loan quantity.

Will need to leap on a chance quickly? Brief-time period loans offer you a boost of money exactly if you need it.

Refinancing and fairness guideToday's refinance ratesBest refinance lenders30-year preset refinance rates15-12 months fastened refinance ratesBest hard cash-out refinance lendersBest HELOC Lenders

Generally, other business debt can’t be used for the deposit, Until payments on the opposite loan aren’t due until eventually after the phrase from the 504 loan.

This means you don’t will need to worry about a large closing payment. Regrettably, there’s a prepayment penalty over the 504 loan for the main 50 percent of the loan time period.

Next, lenders are prepared to just take additional challenges whenever they know the government is there to bail them out.

Intended to assistance customers make self-confident conclusions on-line, this Internet site incorporates details about a wide array of services. Certain specifics, together with although not limited to costs and Specific features, are provided to us directly from our companions and therefore more info are dynamic and subject matter to vary Anytime without prior discover.

When compared to the general SBA 504 loan prerequisites, the proprietor occupancy and public coverage requirements make this business loan application and qualification process way more sophisticated for many businesses.

Danny Tamberelli Then & Now!

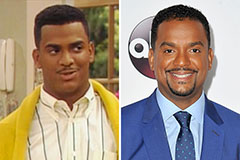

Danny Tamberelli Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!